Client Analysis for 3374223609, 3377148175, 3384595077, 3439964548, 3462064179, 3462142227

The analysis of client accounts 3374223609, 3377148175, 3384595077, 3439964548, 3462064179, and 3462142227 reveals distinct financial behaviors shaped by demographic factors. Each account exhibits unique trends in digital engagement and communication preferences. Understanding these nuances is crucial for developing tailored strategies. The implications of these insights could significantly influence customer satisfaction and loyalty. However, the specific actions needed to optimize these connections remain to be explored.

Overview of Client Accounts

The landscape of client accounts presents a complex array of financial interactions and relationships that merit thorough examination.

Analyzing account performance reveals significant patterns influenced by client demographics, such as age, income, and geographic location.

These factors contribute to understanding individual financial behaviors and preferences, enabling the formulation of tailored strategies that enhance client satisfaction and optimize account performance across diverse client segments.

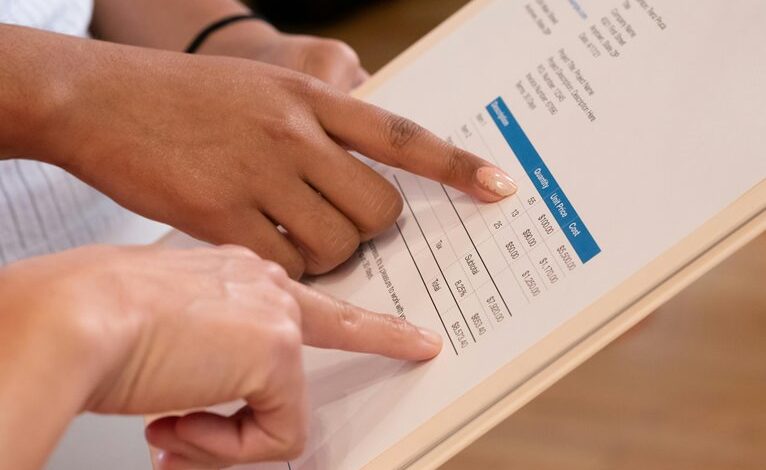

Behavioral Trends and Insights

Understanding client accounts necessitates an exploration of behavioral trends and insights that underpin financial decisions.

Analysis reveals distinct client preferences, highlighting a shift towards digital engagement platforms. Engagement patterns indicate a growing reliance on personalized communication, suggesting that tailored approaches enhance client satisfaction.

Recognizing these trends can empower financial institutions to foster deeper connections and meet the evolving needs of their clientele effectively.

Recommendations for Improved Engagement

While many financial institutions have already embraced digital platforms, a more nuanced approach to client engagement is essential for fostering loyalty and satisfaction.

Implementing personalized content that resonates with individual preferences will enhance client relationships.

Furthermore, leveraging targeted outreach strategies can ensure that communications are relevant and timely, ultimately driving greater engagement and reinforcing the institution’s commitment to meeting clients’ evolving needs.

Conclusion

In summary, the analysis of client accounts reveals distinct financial behaviors shaped by demographic factors, underscoring the need for tailored engagement strategies. As the adage goes, “To know the road ahead, ask those coming back.” By understanding clients’ preferences and adapting outreach methods accordingly, financial institutions can enhance satisfaction and loyalty. Implementing these recommendations will not only strengthen client relationships but also optimize account performance, paving the way for sustained growth and success in a competitive landscape.